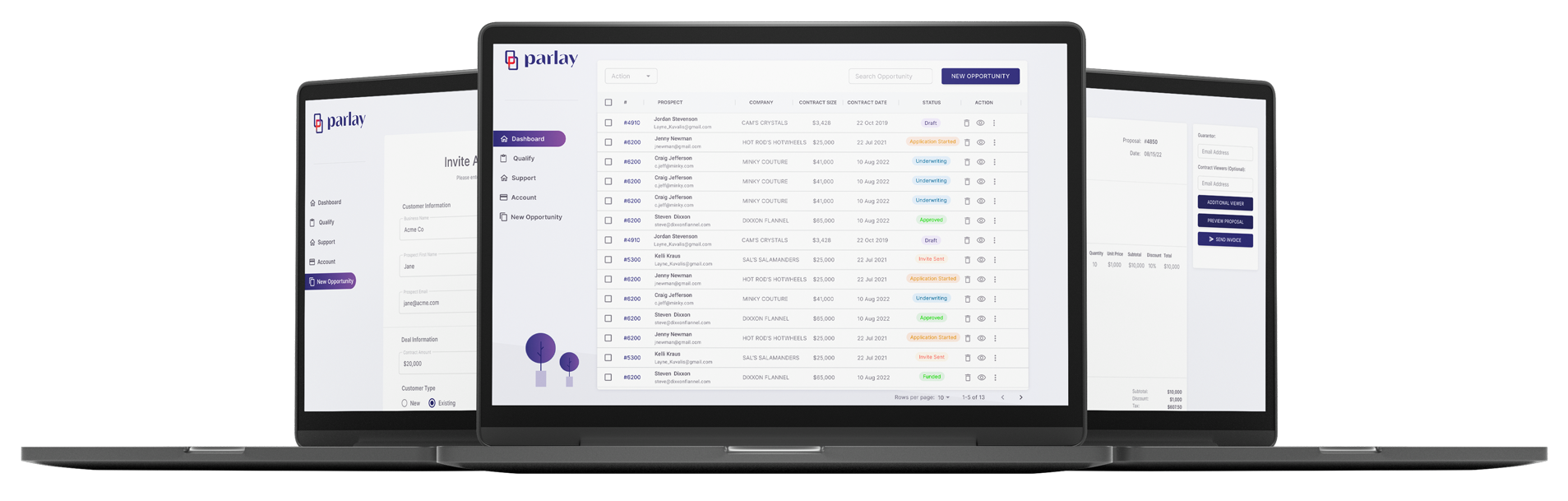

Parlay vs Pipe: What you need to know.

What’s the difference between you and Pipe?

We’ve been getting this question fairly often as of late, so we thought we’d get ahead of it.

Here’s the simple answer. With Pipe, Software Sellers borrow against their own future revenue to access up-front capital today. It’s a creative loan.

With Parlay, on the other hand, the seller is never on the hook to pay anything back. We put that responsibility onto the buyer.

Let’s simplify this all with an example.

Imagine you have a predictable $300,000 that will come in by the end of the year. You’re confident in that number because all of your customers have signed annual contracts and you have already accounted for expected churn rates.

After analyzing your financial standing, Pipe connects you with investors who will offer loan options that lend against your $300,000. This means the seller has a financial and legal obligation to pay back whatever is borrowed.

It’s a non-traditional loan.

This means if you have a higher churn rate than expected, you could be in a tricky situation.

With Parlay, we also offer you up-front capital, but instead of lending against your future assets, we put the financial and legal obligation to pay us back onto the buyer.

We do this in 1 of 2 ways.

The first way is more traditional. We look at the financial records of your buyer and analyze the risk. If they meet our criteria, we offer a promissory note (note payable) to fund their purchase of your software. You get the funds you need to grow faster without dilution or debt on your books.

Yup… No dilution. No debt.

The second method is much less traditional, but enables greater volume and faster deal-to-close timelines.

It’s a bit “secret saucy,” so we don’t go deep into the details in public forums.

If you would like to learn more about this second option or about Parlay in general, please book a meeting with us.

Compromise without compromising.

With Parlay you can provide monthly payment options without jeapordizing annual contract terms.